how to reduce taxable income for high earners 2020

Invest in an HSA to reduce your tax burden and save. Regardless of how you use it though maxing out contributions will lower your taxable income this year providing an opportunity to decrease tax burdens.

How To Reduce Taxable Income For High Earners 20 Ways White Coat Investor

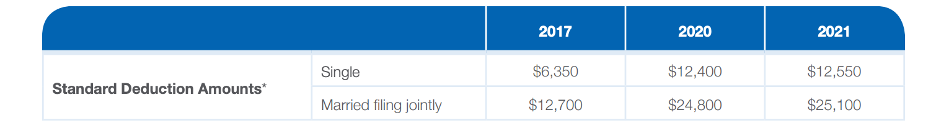

Your tax bracket depends on your taxable incomeyour total income minus allowed deductions and exemptions.

. Lahore High Court LHC has provided relief to the banking sector and other high-income earners to file their income tax returns excluding the Super Tax under section 4C of. Tis the season to make sure youve checked this list not once but twice of strategies to lower your taxable income. One of the easiest and potentially most beneficial ways to reduce your taxable income is to contribute to a pre-tax retirement account such as an employer-sponsored.

These tactics are the perfect gift to unwrap this season to lessen your. There is not an income limit to charitable donation deductions. This video gives a few suggestions on how to reduce taxable income in order to pay fewer taxes.

How to reduce taxable income for high earners 2020. Whether you donate clothes food or any other items as long as you have a receipt for those from a recognized non-profit those donations can lower your tax bill. Many employers offer qualified retirement savings plans such as 401 K 403 b and 457 plans to help attract qualified.

Best Ways To Reduce Taxable Income for High Earners in 2020. How To Reduce Taxable Income For High Earners 2020. The 2022 federal income tax bracketsare as follows.

One way to reduce your tax burden is to change the character of your income. Thats a tax saving between 9360 24 marginal rate and 14430 37 marginal rate. A married couple can reduce taxable income by 39000.

Another one of the best tax reduction strategies for high-income earners is to. Best Ways To Reduce Taxable Income for High Earners in 2020. Charitable donations are an.

Qualified retirement plan contributions. While health insurance is expensive health savings accounts can provide many benefits for people with high incomes. 50 Best Ways to Reduce Taxes for High Income Earners.

Change the Character of Your Income. 15 on the first 50197. Participate in employer sponsored savings accounts for child care and.

With a daf you can make a donation receive an immediate tax deduction and then recommend grants to be. Febrero 7 2022 por por. Tax Saving Strategies for High-Income Earners.

Low maintenance haircuts for thick hair male. But you cannot deduct more than 60 of your adjusted gross income AGI. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

How to Reduce Taxable Income 1. Contribute significant amounts to retirement savings plans. If you are an employee.

If your work or assets.

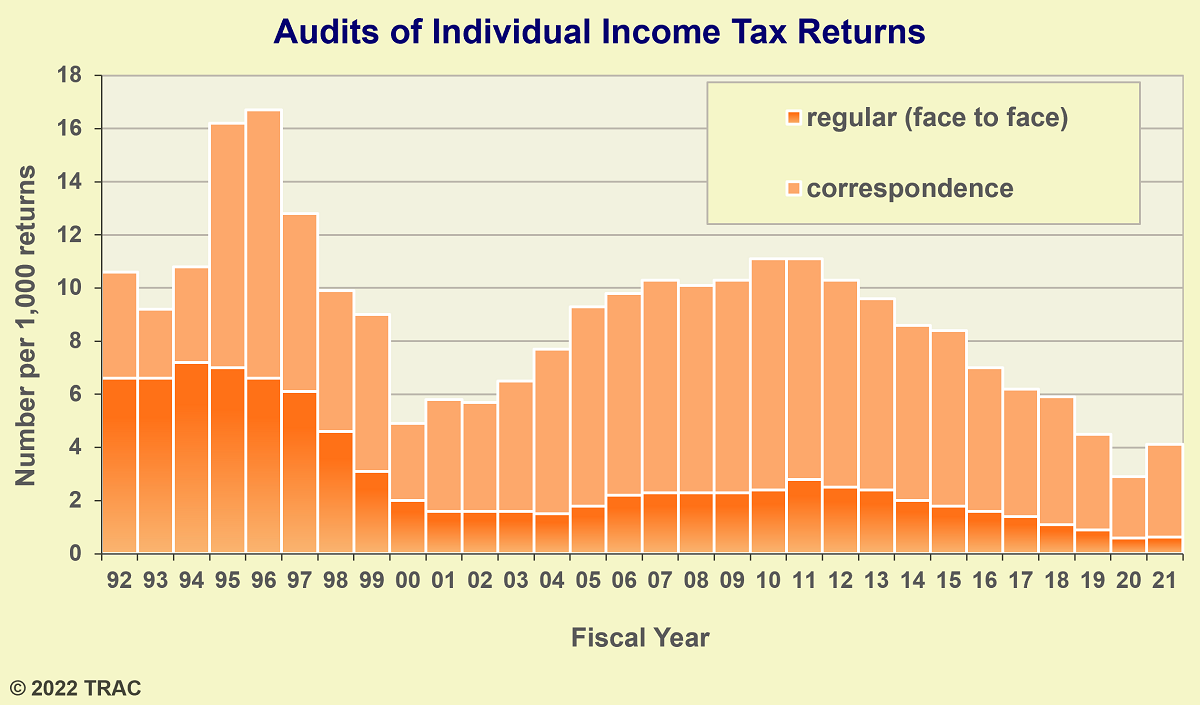

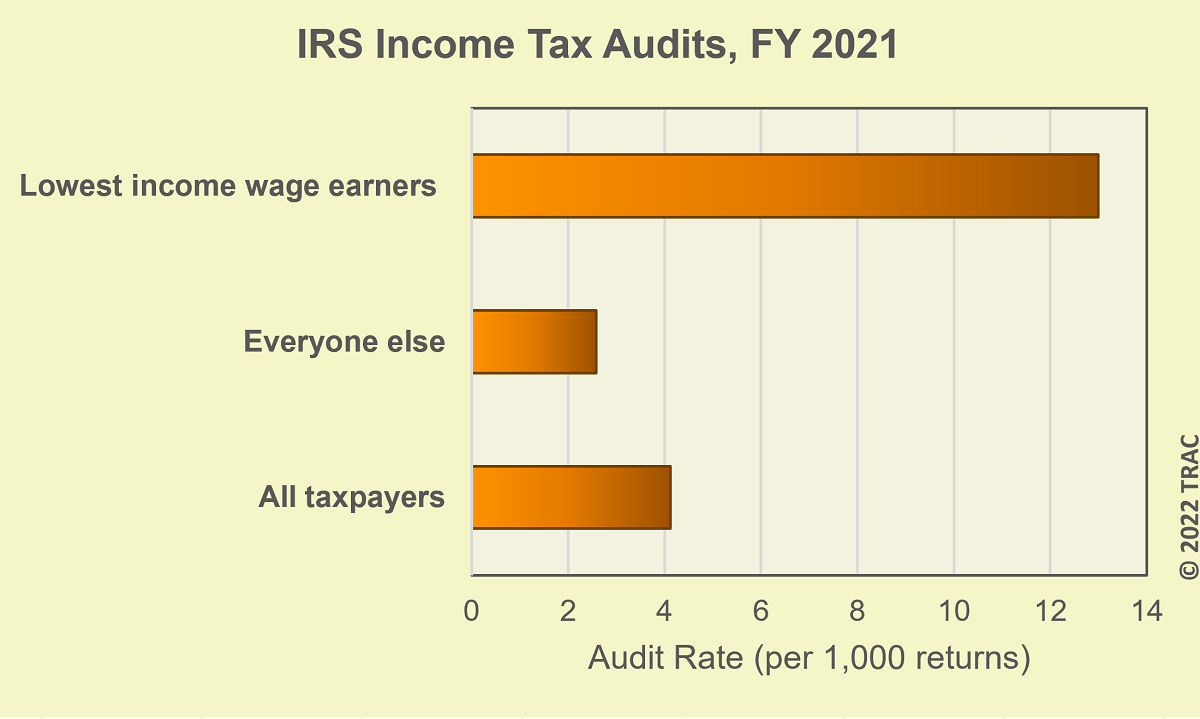

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Tax Saving Strategies For High Earners Part I Stacking Bwm Financial

Tax Strategies For High Income Earners Wiser Wealth Management

The Hierarchy Of Tax Preferenced Savings Vehicles

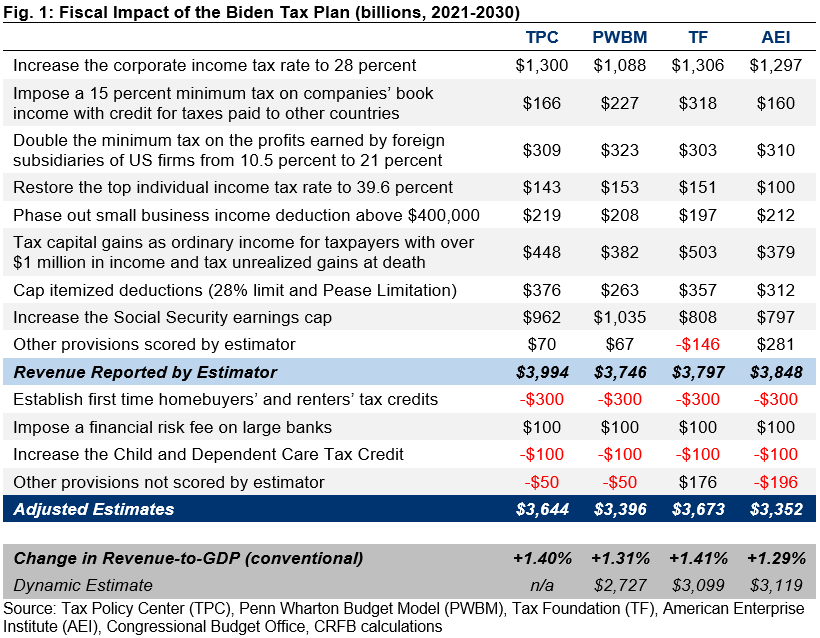

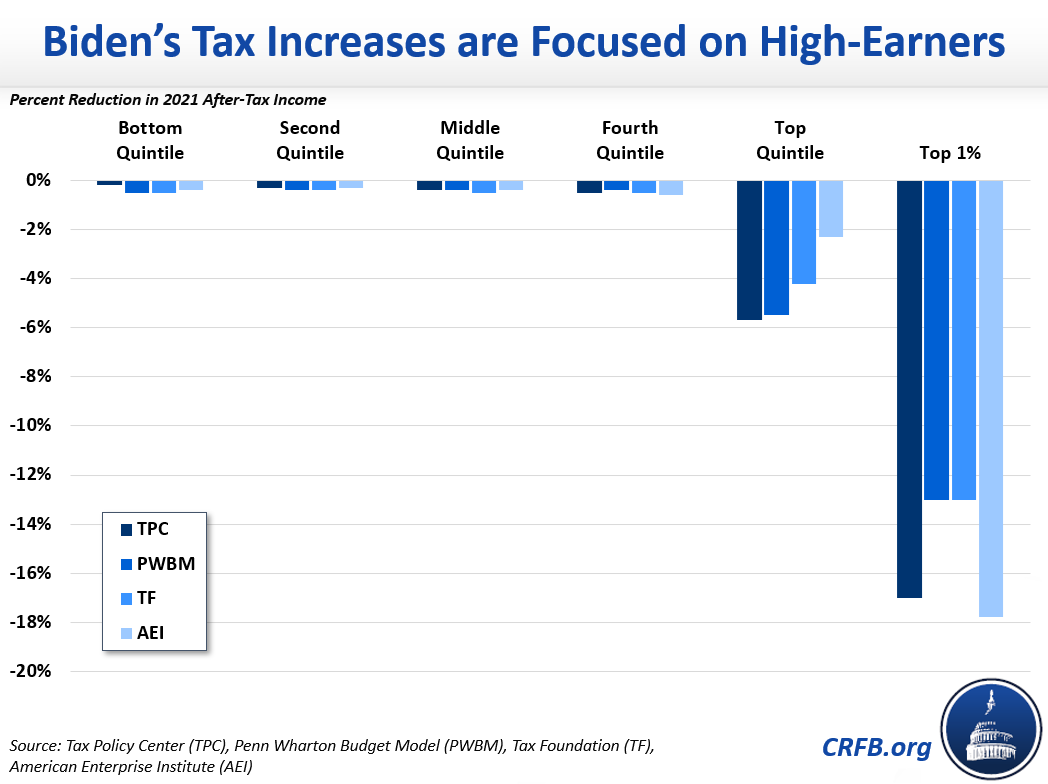

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

9 Ways For High Earners To Reduce Taxable Income 2022

6 Strategies To Reduce Taxable Income For High Earners

Easy Ways To Tax Reduction For High Earners In 2020 Save 100 000 To 1 Million Youtube

Tax Reduction Strategies For High Income Earners 2022

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Tax Reduction Strategies For High Income Earners 2022

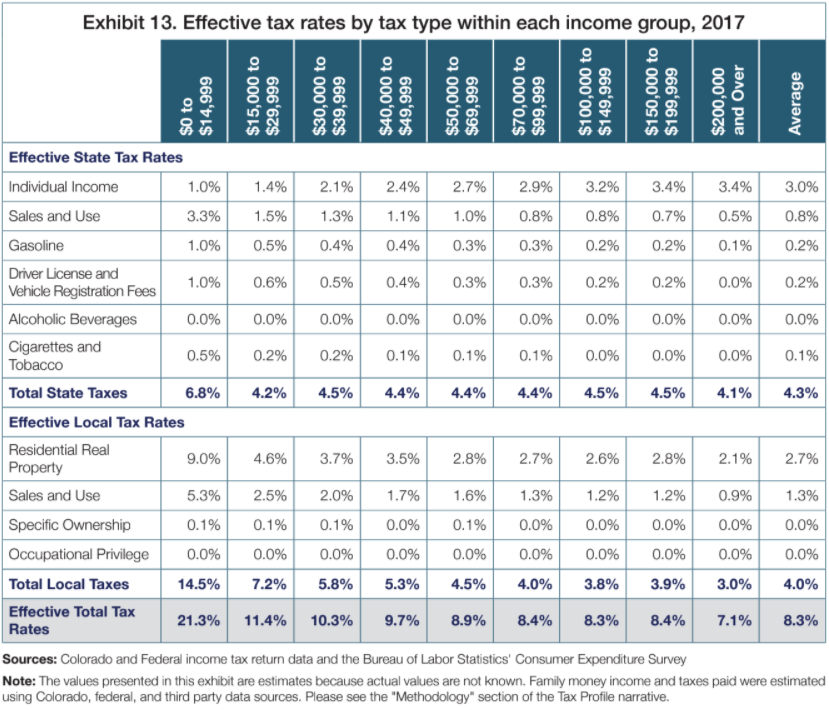

Regressive Taxation In Colorado Two Competing Views Independence Institute

Would Joe Biden Significantly Raise Taxes On Middle Class Americans Committee For A Responsible Federal Budget

20 Holds Tax Cut For High Earners In Arkansas Rate In State Drops To 6 6 As Latest Reduction Phases In

What Are Marriage Penalties And Bonuses Tax Policy Center

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

9 Ways To Reduce Your Taxable Income Fidelity Charitable